What Goes Into Horizontal Land Development?

Whether you’re constructing a single-family home, buying undeveloped land, or developing a multifamily property, there are a number of things to take into account when you require financing for your real estate investment project. In fact, since each stage of the construction process requires money to add value to the project, each stage can be funded independently. Whether you want to sell a project for a profit or move it to the following stage of development, make sure to engage with an expert lender who is knowledgeable about the kind of property you’re dealing with.

The many phases of real estate development will be discussed in this article, along with how effective financing may significantly increase the value of each phase. No matter what stage of a real estate project you decide to get engaged in, identifying these details in advance is essential to its success.

The Land Development Process In 6 Steps

The process of developing raw land is frequently seen as a difficult investment plan that should only be undertaken by “experts.” Although buying undeveloped land is a complicated investment, novice investors shouldn’t always steer clear of it. On fact, I would contend that novice investors can make money in undeveloped land provided they do due research and get ready for harder work than is typically required for conventional exit plans. Developing undeveloped land involves extra processes, at the very least.

What Goes Into Horizontal Land Development ?

As an investor, there are plenty of opportunities in the real estate sector. Investing in residential, multifamily, and commercial buildings is just one of the many alternatives the real estate sector provides to potential investors. Investing in raw land is one of the more underutilised financial options, and there is no longer a good reason to disregard it.

What Is Raw Land Development?

The process of buying a plot of land with the intention of either developing and building on it or keeping it for future appreciation is known as raw land development. Although there are several ways to invest in raw land, they all fundamentally offer a number of advantages over other forms of investments, including the ability to sell the property, rent it out for passive income, or simply enjoy appreciation while doing little to no labour.

How To Develop Land In 6 Steps: The Raw Land Development Process

Undeveloped real estate has the capacity to produce the same steady cash flow as any other kind of investment opportunity, it remains a truth.

Fortunately for investors, raw land is a tremendously desirable resource due to its scarcity. It’s possible for your land to increase in value if you buy it in a region that is expected to experience expansion and development.

Investors wishing to develop undeveloped land should exercise due diligence and do their research on the market they intend to participate in. The easiest method to achieve this is to keep an eye on market trends.

Understanding the market’s cyclical behavior will help you decide when to buy. You must first look at current changes in your chosen market. Buyers will probably be searching for property if there has recently been a spike in development projects in the neighborhood. It is also prudent to consider the expansion of neighboring markets.

Now that you have a general understanding of raw land as an investment, let’s walk you through the development of raw land step by step.

- Evaluate its economic feasibility

- Determine the offer price

- Find out what the land is zoned for

- Secure your financing

- Begin building within zoning laws

- Market the land/property to sell

-

Economic Feasibility

Analyzing the viability of investing in raw land is the first stage. Determine your desired return on the property before beginning, as with any real estate investment. This is crucial since it will reduce market uncertainty and offer a model for the expenses against profits of your venture. Investors will succeed if they grasp the feasibility of your project, including the expected costs, revenues, and overall return, even though the numbers will only be estimates.

-

Acquisition

You may more accurately establish the offer price after you are aware of the charges you’re probably going to incur, as well as what you ought to get in exchange. At this point in the process, investors must request that contractors submit genuine bids for the project. This will not only give you an idea of the project’s predicted costs, including how much money you can expect to spend, but it will also give you the maximum offer price.

-

Zoning

The third stage of raw land investment focuses mostly on the layout of the land. In essence, this has to do with what kind of property ought to be built on the plot, taking local zoning laws into consideration.

Zoning will be a key factor in how you proceed, depending on the kind of property you want to build or how you plan to market it to purchasers. Zoning regulations will essentially dictate what kinds of buildings can be constructed on the property, including single-family, multifamily, condominium, and commercial buildings. This can ultimately hurt your investment strategy as an investor. Understanding the local zoning restrictions is crucial when beginning to invest in raw land.

-

Financing

The type of financing you acquire will depend on how you intend to use the property, as with all real estate transactions. The loan-to-cost ratio is the one factor that investors need to pay close attention to (LTC). The LTC, which will typically depend on the type of construction and use of the property, is essentially the sum of money that the lender will contribute to the project. Owner-occupied homes are eligible for regular bank financing, even though the majority of lenders will only contribute a portion of the total costs (often between 80 and 85 percent).

-

Construction

Construction is the next-to-last step in the development of raw land. Typically, this involves grading for roads, curbs, and utilities as well as eventually constructing the property from the ground up. Investors should also be aware of the project’s construction financing component. In general, contractors will be paid in accordance with the tasks completed, including project phases. Construction lenders frequently reserve around 10% of the construction loan until the job is finished.

-

Marketing

Marketing is the last stage of the land development process. In this situation, stage one is vitally important. When choosing your marketing strategy, doing your research on the area, the rental market pricing, and the demand for rentals will pay off. A marketing strategy should be in place for investors to draw buyers to the property. This could entail using a realtor, internet listings, the MLS, newspaper advertisements, or even social media.

Raw Land Loans

If you want complete customization for your project and are okay with taking a little longer to create it, buying raw land can be the best option. If you want to construct many buildings, you might wish to buy an infill lot in a crowded urban region or land in a suburban area that can be subdivided into individual lots. You can get a land loan to buy this plot of land so you can start your development there.

The marketability of the land and how it will impact any upcoming projects that will be developed on it are important factors to take into account when assessing the risks of buying land. Some lenders, who refer to themselves as “land banks,” focus on financing the purchase of undeveloped land before the true viability of a project can be assessed, increasing the risk of the loan.

Other lenders take part in the purchase of raw land as long as certain conditions are met. This typically entails cross-collateralization of other features and proof of feasibility studies. These kinds of loans from “non-land bank” lenders typically require a path to entitlement and the lender’s ability to finance future phases of development.

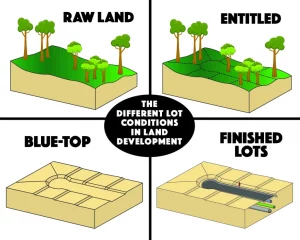

Horizontal Development Loans

In order to prepare a plot of land for vertical construction, horizontal development involves constructing infrastructure and securing necessary permits. This can entail completing the land’s permitting, putting in utilities, or pouring a concrete pad, as a few examples. In general, each of these components will be present in a horizontal development loan.

In many circumstances, borrowers might not have access to the money needed to advance a project to the following stage (vertical construction). Loans for horizontal development may be able to fill this gap. It’s currently tough to renew an existing land loan without making extra capital commitments due to the over-leveraged loans in the market. Look for a lender who uses less leverage and underwrites for both the horizontal and vertical construction phases simultaneously. This makes sure there is enough equity to fund vertical construction without having to raise more money. Additionally, if the initial lender does not offer financing for the vertical building phase, this will enable you to refinance with a different lender.

Vertical Construction Loans

When most people picture a property being developed, they picture the vertical construction phase, which includes building the structure itself. Numerous asset classes, such as developments of single-family homes, apartment buildings, townhomes, or condominium complexes, may be included.

Most construction loans typically have a portion of the loan held back in an escrow account, which is then released on a predetermined schedule whenever a predetermined portion of the construction is finished and validated by an inspector. By doing this, the lender’s risk is reduced while still giving the borrower the money they require at each stage of the procedure.

Post-Construction Loans

Financing is frequently required to stabilize a project after it has been completed but before its full profitability has been achieved. This refers to producing income for a property used as an investment. For a property to be eligible for long-term financing that will support it over its existence, stabilization is frequently necessary. If a borrower is unable to lease a property, they must collaborate with the lender to decide how to proceed (i.e. negotiating modifications to the loan).

Conclusion

As we’ve seen, getting money at these different stages of your development is essential to making sure it succeeds. Regardless of the stage at which you become engaged, be sure to work with a lender like Broadmark Realty Capital who has the experience, solid balance sheet, and technical know-how to maximize the value of your real estate project.

It could be time to research the raw land development procedure if you’re seeking for a successful real estate investment approach. A terrific low-cost approach to increase the size of your real estate portfolio is by investing in land. If you want to succeed in developing raw land, take the methods mentioned above. As you begin to implement this investment approach, keep in mind to significantly rely on research. Always plan your investment taking future changes in the area into account. Put yourself above the competition right now by boosting your portfolio with a raw land investment.

An internally managed real estate investment trust (REIT), Broadmark Realty Capital Inc. (NYSE: BRMK), provides short-term, first deed of trust loans backed by real estate to finance the purchase, renovation, rehabilitation, or construction of residential or commercial properties. Since its founding, the company has created over $2.2 billion in loans through an aggressive and flexible underwriting process. Have inquiries? Speak with a member of our loan team right away.