Bitcoin Expert Prediction 2022- Crypto Will Be More Down in India Expect Below 20 Lakh

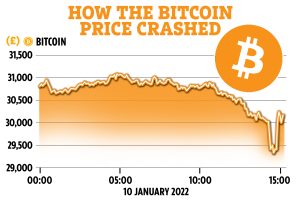

New Delhi, India: The cryptocurrency market has been under pressure from sellers, with major crypto coins shedding almost 25% of their value in only four days. In the last seven sessions, the majority of the tokens have lost double digits.

After Russia’s central bank called for a crackdown on cryptos, the new round of selling began. On Thursday, Russia’s central bank suggested prohibiting the usage and mining of cryptocurrencies on its soil, citing concerns to financial stability, individuals’ well-being, and the country’s monetary policy sovereignty.

Governments from Asia to the United States are concerned that privately controlled and extremely volatile digital currencies could undermine their control of financial and monetary systems, and this is the most recent move in a worldwide cryptocurrency crackdown.

The move by Russia, one of the world’s top crypto adopters, dampened market sentiment and sent the digital asset market into free fall.

While this may be cause for alarm, the cryptocurrency business has survived many bans, restrictions, and governmental scrutiny over the years, according to the CoinDCX Research Team.

“Given how quickly the industry recovered following China’s crypto ban, we may expect the sell-off to have a minor long-term influence on crypto’s performance,” it added.

Sluggish macroeconomic conditions, rising oil costs and Federal Reserve tapering signals, rising inflation, and a collapse in the technology industry are all contributing to investors’ problems.

Bitcoin has surpassed the $39,000 mark, down more than 11% from its all-time high. Ethereum, on the other hand, has dropped 14% to $2,800 levels.

Altcoins have been hit worse, with BNB, Cardano, and Polkadot losing up to 18% in the last 24 hours, according to Coinmarketcap data.

Volatility is one of the most distinguishing characteristics of cryptocurrency markets, and understanding the market cycle is equally critical.

The uncertainty surrounding the Crypto Bill across the globe, according to Vikas Ahuja, CEO of CrossTower India, is one of the factors that has caused a volatility in cryptocurrency prices.

“China’s decision to shut down Bitcoin mining in Sichuan province has resulted in a drop in cryptocurrency market value. “he remarked, while expressing hope for a quick recovery.

Bitcoin and Ethereum have lost 10-13 percent of their value in the last week, while other prominent altcoins such as Dogecoins, Solana, Avalanche, and Polygon have lost 16-25 percent of their worth.

Due to low trade volumes, which have recently hovered around $75 billion per day, the overall market capitalization of crypto assets has dropped below $1.9 trillion.

In other news, the US Securities and Exchange Commission (SEC) has rejected a filing by First Trust Advisors and SkyBridge, the hedge firm formed by former White House communications director Anthony Scaramucci, to list and trade a spot bitcoin exchange-traded fund.

According to Nitish Sharma, Global CEO, TP Global FX, the SEC’s denial of the First Trust SkyBridge Bitcoin ETF Trust was the latest in a series of vetoes by the agency regarding the listing of spot bitcoin ETFs, which seek to provide easy exposure to the digital currency. “These denials by regulatory agencies around the world have shattered investor faith in digital assets, resulting in a massive selloff,” he continued.

According to Edul Patel, CEO and Co-Founder of Mudrex, the downward trend is expected to throw investors into chaos, and the coming week will be crucial for the crypto spectrum.