Budget 2023 Key Highlights LIVE- Blogs Year

Key points of the Budget 2023: The Modi administration’s goals are the construction of roads, highways, and railway lines, as seen by the Budget for 2023–24’s continued emphasis on increasing Capex. With adjustments to the new income tax system, the middle class has received some respite, making it quite evident that the government intends to switch from the old system to the new one. With a target of 5.9% in FY 24 and adherence to the aim for the current fiscal year, the FM committed to the fiscal deficit plan in the Budget.

Also Read:- New Income Tax Slab Budget 2023 LIVE Updates- Blogs Year

features of the 2023 budget for aviation

– Nirmala Sitharaman, the minister of finance, revealed on Wednesday that the capital spending for infrastructure development for 2023–2024 will increase by 33% to Rs 10 lakh crore, or 3.3 percent of the GDP.

– When introducing the budget, she said that the recently created infrastructure finance secretariat will help to increase private investment.

She said that the government would resurrect 50 more airports, helipads, water aero drones, and advanced landing grounds in an effort to significantly enhance regional air connectivity.

– The Union Civil Aviation Ministry received funding from the Budget totaling Rs. 3,113.36 crore.

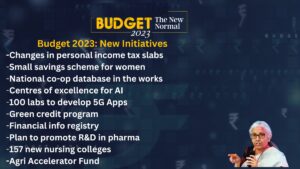

New Initiatives in the 2023 Budget

Artificial intelligence is a key component of the budget’s digital ambitions for the education sector.

100 laboratories in engineering institutions will be developing applications employing 5G services. Three centres of excellence for artificial intelligence will be established in leading educational institutions.

– A national digital library for kids and teens will be established to make good books more accessible across genres, geographies, and languages.

– The centre plans to hire 38,800 teachers and support staff for the 3.5 lakh indigenous pupils who would attend the 749 Eklavya Model Residential Schools.

Budget 2023: Seniors will benefit greatly.

– The Senior Citizen Savings Scheme, a well-liked investment among the elderly, has doubled its maximum permitted investment as of Budget 2023. The monthly income plan offered by the post office has also been improved.

– Nirmala Sitharaman, minister of finance, quadrupled the Senior Citizen Savings Scheme (SCSS) maximum limit from Rs. 15 lakh to Rs. 30 lakh. The programme offers an annual guaranteed interest rate of 8%. Interest is paid on a quarterly basis.

– In addition, the investment cap for the well-known POMIS (Post Office Monthly Income Scheme) has increased from Rs 4.5 lakh to Rs 9 lakh. The investment cap for combined POMIS accounts has increased from Rs. 9 lakh to Rs. 15 lakh. The programme pays interest at a monthly rate of 7.1 percent annually.

Highlights for the defence industry in Budget 2023

– The Ministry of Defence has been given the biggest allocation of any ministry, at Rs 5.94 lakh crore, but this is hardly a considerable increase from Rs 5.25 lakh crore for current fiscal year.

– Following the conclusion of Finance Minister Nirmala Sitharaman’s Budget address, shares of Bharat Electronics, Bharat Dynamics, Hindustan Aeronautics, Paras Defence, and BEML all experienced a 5–9% decline.

– The government has prohibited the importation of a number of commodities, including essential components used in defence equipment, as part of its ambitious Atmanirbhar Bharat scheme. Which implies that they are now being produced in India.

Highlights of Budget 2023, according to industry professionals

– According to Radhika Gupta, managing director and chief executive officer of Edelweiss Mutual Fund, the budget’s emphasis on tourism is excellent. “The budget’s emphasis on tourism makes me very delighted. India’s tourist industry has enormous untapped potential and, in addition to its soft power, can significantly boost GDP. I’m eager to witness and support action on the ground, “Tweeted she.

– Nilesh Shah, MD of Kotak Mahindra, stated that the removal of the tax exemption is obviously bad for the insurance industry and will have an impact on business, which is reflected in prices.

– Colonel Sanjeev Govila, CEO of Hum Fauji Initiatives, claimed that the new tax system has been improved, gradually rendering the old tax system’s exemptions unnecessary.

– According to Harsh Goenka, chairman of RPG Enterprises, it is a wise budget that prioritises infrastructure, employment, and demand driven by consumption while limiting the fiscal deficit. Builds on the assets of the middle class, digital talent, and manufacturing, he tweeted.

– According to Amitabh Kant, a former CEO of NITI Aayog, this budget will boost Indian consumer spending. The budget’s focus on becoming digital throughout the economy, he continues, was its genuine high point.

Highlights for the renewable energy sector in Budget 2023

– This budget increases funding for the renewable energy sector by 48%.

– The budget estimate for this year’s allocation is Rs 6,900.68 crore, a 45.3% increase over the RE of Rs 7,033 crore.

Highlights of the IT ministry’s budget for 2023

– The Ministry of Electronics and Information Technology’s budget projection has grown from Rs 11,719.95 crore to Rs 16, 549.04 crore.

– The budget estimate for this year is nearly twice as large as it was two years ago, at Rs 8,118.65 crore for the year of 2021–22.

Highlights of the Road Ministry’s Budget 2023

– In the budget year 2023–2024, funding for the ministry of roads, transportation, and highways (MoRTH) increased by 36% to approximately Rs 2.7 lakh crore.

– The MoRTH’s capital expenditure plan for 2023–2024 includes an estimated Rs 1.62 lakh crore for the National Highways Authority of India (NHAI).

– According to the updated projections from the government, the NHAI will spend Rs 798 crore as IEBR in 2022–2023.

Budget 2023 Highlights: New budget tax slab

Under the new personal tax regime, six income slabs have been reduced to six. The government has also increased the tax exemption limits in some of these categories.

- 0-3 lakh- nil

- 3-6 lakh -5%

- 6-9 lakh – 10%

- 9-12 lakh-15%

- 12-15 lakh -20%

- Above 15 lakh – 30%

People who are earning an income of Rs 9 lakh a year will have to pay only Rs 45,000 a year as tax. That is 5% of their income or a reduction of 25 percent from the Rs 60,000 they were paying earlier.

Union Budget 2023 Highlights: Nirmala Sitharaman lists 7 priorities

- Inclusive development

- Reaching the last mile

- Infrastructure and investment

- Unleashing the potential

- Green growth

- Youth power

- Financial sector

Highlights of the 2023 budget: Customs fees

– India’s production of mobile phones surged from 5.8 billion units worth at roughly Rs 18,900 billion in 2014–15 to 31 billion units valued at Rs 2,75,000 billion in the most recent fiscal year.

– A one-year extension of the customs duty exemption for certain mobile phone components such camera lenses and batteries.

Budget 2023 Key Highlights: Digilocker

– FM Nirmala Sitharaman has announced the growth of the government’s Digilocker services for the fintech industry.

– The focus of DigitLocker’s development into the fintech sector would be on making documentation readily available. “The fintech sector has been made possible by digital services, PM Jan Dhan Yojana, Indian Stack, and UPI,” Sitharaman added.