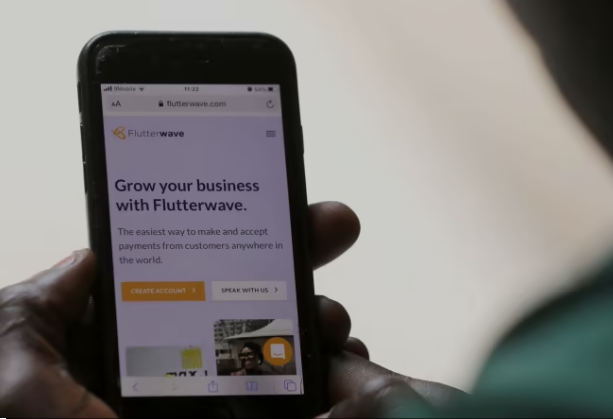

Flutterwave Scandal: Is It Safe to Use in the USA? What Happened in Kenya?

In the fast-paced world of online payments and financial technology, Flutterwave has gained significant attention as a payment processing platform. However, recent events have raised concerns and questions about its safety and operations. In this article, we’ll dive into the Flutterwave scandal, its safety, availability in the USA, and the specific issues it faced in Kenya.

Also Read:- Npower News: Mission, Status, and Updates

What Happened with Flutterwave?

Flutterwave is a Nigerian fintech company that provides payment solutions for businesses and individuals. It has gained popularity for its ease of use and ability to facilitate cross-border transactions. However, in recent months, Flutterwave has been embroiled in a scandal that has left many users and investors worried.

The scandal revolves around allegations of financial misconduct and mismanagement within the company. Reports have surfaced about questionable financial practices, including misappropriation of funds, delayed payments to merchants, and issues related to compliance and regulatory standards.

Is Flutterwave Safe to Use?

The Flutterwave scandal has understandably raised concerns about the safety and reliability of the platform. Users who rely on Flutterwave for their payment processing needs are left wondering whether their financial transactions are secure.

It’s essential to note that Flutterwave has taken steps to address the issues raised in the scandal. The company has initiated internal investigations, and key personnel changes have been made to restore trust and transparency. Additionally, Flutterwave has reaffirmed its commitment to compliance with regulatory standards.

However, it’s crucial for users to exercise caution when using the platform. Before entrusting your financial transactions to any service provider, it’s advisable to conduct thorough research and consider alternatives if you have concerns about its safety.

Is Flutterwave Available in the USA?

Flutterwave initially focused on providing its services primarily in Africa. However, as the company expanded its operations, it made efforts to extend its reach beyond the continent. This expansion included making its services available in the United States.

As of the latest information available, Flutterwave is indeed available for use in the USA. This move has allowed American businesses and individuals to access the platform’s payment processing capabilities, facilitating seamless transactions both domestically and internationally.

What Is the Issue with Flutterwave in Kenya?

Kenya has been a significant market for Flutterwave, given its growing economy and the country’s increasing reliance on digital payment solutions. However, Flutterwave faced unique challenges in Kenya that contributed to the overall scandal.

One of the primary issues in Kenya was related to compliance with local regulations. Flutterwave encountered difficulties in adapting to Kenya’s specific regulatory framework, leading to legal and operational challenges. Additionally, there were reports of delayed payments and disputes with Kenyan merchants, further eroding the company’s reputation in the region.

Flutterwave has been working to address these issues in Kenya by collaborating with local authorities and stakeholders to ensure compliance and improve its services to Kenyan users.

FAQs: Flutterwave Scandal

Q1: What is the Flutterwave scandal?

The Flutterwave scandal refers to allegations of financial misconduct and mismanagement within the Nigerian fintech company, Flutterwave, including issues related to misappropriation of funds, delayed payments, and compliance concerns.

Q2: Is Flutterwave safe to use?

While Flutterwave has taken steps to address the scandal and improve its operations, users should exercise caution and conduct their due diligence before using the platform for financial transactions.

Q3: Is Flutterwave available in the USA?

Yes, Flutterwave is available for use in the United States, allowing American businesses and individuals to access its payment processing services.

Q4: What issues did Flutterwave face in Kenya?

Flutterwave faced challenges in Kenya related to compliance with local regulations, as well as disputes with Kenyan merchants and delayed payments, impacting its reputation in the country.

In conclusion

the Flutterwave scandal has brought to light important questions about the safety, availability, and operations of this fintech company. While Flutterwave is taking steps to address the issues raised, users are advised to exercise caution and conduct thorough research before using its services. Additionally, its experiences in Kenya highlight the challenges that fintech companies can face when operating in different regulatory environments. Stay informed and make well-informed decisions when it comes to your financial transactions.