From A Bitcoin Crash To Regulatory Crackdowns: Analysts Give Their Top Predictions For Crypto In 2022

In the grand scheme of things, bitcoin has had a pretty nice year. Since the beginning of 2021, the digital currency has increased by about 70%, bringing the total worth of the crypto market to $2 trillion.

It’s been a year marked by the emergence of the first big crypto business, Coinbase, in April, growing participation from Wall Street banks like Goldman Sachs, and the approval of the first bitcoin exchange-traded fund in the United States.

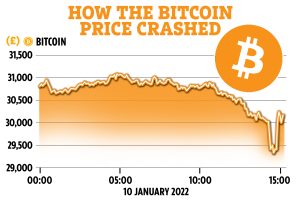

However, recent price volatility and increased regulatory scrutiny have dimmed bitcoin’s prospects. Experts also warn that the market may be on the verge of a downturn.

With next year already shaping up to be another roller-coaster ride for digital currencies, CNBC examines some of the most prominent analysts’ predictions.

Crash Of The Cryptocurrency Market

Bitcoin, according to some experts, is set to plummet in the next months. In November, the cryptocurrency hit a new high of around $69,000. It’s currently worth less than $50,000, down about 30% from its high. Bear markets, according to Wall Street thinking, are defined as a drop of 20% or more from recent highs, but bitcoin is infamous for its volatility.

Alexander forewarned that history will repeat itself. After soaring to a high of nearly $20,000 a few months prior, bitcoin fell close to $3,000 in 2018. Supporters of bitcoin frequently claim that things are different this time because more institutional investors are entering the market.

“Without a doubt, Bitcoin’s price chart appears to match many past asset bubbles and busts, and it’s carrying a ‘this time it’s different’ narrative like other bubbles,” said Todd Lowenstein, chief equities strategist at Union Bank’s private banking unit.

The use of bitcoin as a hedge against rising inflation generated by government stimulus is a popular investment case. According to Lowenstein, a more hawkish Federal Reserve might take the wind out of bitcoin’s sails.

Carol Alexander, a finance professor at Sussex University, believes bitcoin will crash to $10,000 in 2022, wiping out all of its gains over the previous year and a half.

“If I were an investor right now, I’d consider exiting bitcoin shortly because its price is certain to fall next year,” Alexander added. Her negative prediction is based on the idea that bitcoin “has no intrinsic worth” and is more of a “toy” than an investment.

“Goldilocks conditions are ending, and the liquidity flow is receding,” he said, adding that inflated asset classes and speculative sections of the market, such as cryptocurrencies, will be disproportionately harmed.

Even then, not everyone believes the crypto party will come to an end in 2022. “The main risk factor, notably [quantitative tapering] by the Fed, has already been chosen and presumably priced in,” said Yuya Hasegawa, a crypto market analyst at Bitbank in Japan.

Bitcoin ETF is Ranked first.

The approval of the first spot bitcoin exchange-traded fund in the United States is a major event that crypto investors are anticipating in 2022.

Despite the fact that the Securities and Exchange Commission approved ProShares’ Bitcoin Strategy ETF earlier this year, the product monitors bitcoin futures contracts rather of providing investors with direct exposure to the cryptocurrency.

Futures are financial contracts that bind an investor to purchase or sell an asset at a predetermined price at a later date. Experts warn ProShares’ ETF, which tracks futures prices rather than bitcoin values, could be too dangerous for beginner traders, many of whom are already involved in crypto.

“Given the high costs involved in rolling over contracts, which amounts to around 5-10 percent,” said Vijay Ayyar, vice president of corporate development and global expansion at crypto exchange Luno, “the Bitcoin Futures ETF that launched this year has been widely regarded as not very retail-friendly.”

“Increasing pressure/evidence… leads to the approval of a Bitcoin Spot ETF in 2022, mostly because the market is now large and mature enough to support one.”

Grayscale Investments has filed to convert its bitcoin trust, the largest bitcoin fund in the world, into a spot ETF. There are also a slew of other bitcoin ETF proposals in the works.

Rotation into the ‘DeFi’ mode

Bitcoin’s market share has dwindled as the crypto sector has matured, with other digital currencies such as ethereum now playing a significantly larger role. Analysts expect this trend to continue throughout next year, as investors seek for tiny pockets of cryptocurrency in the hopes of making large gains.

Decentralized banking and decentralised autonomous organisations, according to Bryan Gross, network steward of crypto platform ICHI, are “expected to be the biggest growth sectors of crypto.” DAOs can be seen as as a new sort of internet community, while DeFi tries to recreate existing financial goods without the need of middlemen.

This year, the total amount of money placed into DeFi services reached $200 billion for the first time, and experts predict that demand will continue to rise through 2022.

DeFi is a subset of the Web3 trend in technology. The Web3 movement advocates for a new, decentralised internet that includes blockchain and cryptocurrency technologies such nonfungible tokens. However, it has already attracted critics in the form of Elon Musk and Jack Dorsey.

‘Regulatoryly, it’s been a big year.

This year, regulators exercised their muscles on cryptocurrencies, with China outright prohibiting all crypto-related operations and the US government tightening down on specific areas of the business. Analysts predict that regulation will be a major issue for the industry in 2022.

“No doubt, 2022 will be a huge year on the regulatory front,” Luno’s Ayyar predicted. “Various countries’ interest in bringing legislation to the crypto realm, particularly in the United States, has never been higher.”

Ayyar believes the legal “grey zone” of cryptocurrencies other than bitcoin and ethereum, which the SEC has said are not securities, will be clarified.

Ripple, a blockchain business, is at odds with the US Securities and Exchange Commission over XRP, a cryptocurrency with which it is intimately tied. The SEC claims that XRP is an unregistered security and that Ripple and two of its executives illegally sold $1.3 billion worth of tokens. Ripple, for one, claims that XRP should not be considered a security.

Ethereum, solana, polkadot, and cardano are among the coins to watch in 2022, according to Alexander of Sussex University.

Stablecoins are another significant area authorities are expected to focus on next year, according to experts. These are digital tokens whose value is determined by the price of existent assets such as the US dollar. Tether, the world’s largest stablecoin, is especially divisive, with questions regarding whether it has enough assets in its reserves to support its dollar peg.”Stable coins will undoubtedly face increased scrutiny as regulators examine the integrity of the underlying collateral and the level of leverage used,” said Lowenstein.

“People remember all too well when the collateral underlying the housing and mortgage crises became suspicious and risk appetites aggressively repriced,” says the author.

Meanwhile, regulators have begun to examine the DeFi market. The Bank for International Settlements, a central bank umbrella group, advocated for DeFi regulation earlier this month, citing concerns about services claiming to be “decentralised” when they aren’t.

“As ordinary investors become aware of the risks of trading bitcoin, particularly on unregulated exchanges,” she said, “they will shift to… other coins belonging to blockchains, which perform a crucial and basic role in decentralised finance.”

“By this time next year, I think bitcoin’s market cap will be half or even less than the aggregate market cap of smart contract coins like ethereum and solana,” Alexander continued.