Taxes And Cryptocurrency

More and more people are investing in this new asset class as a result of cryptocurrencies’ soaring popularity. Yet taking a chance on this market is dangerous. You can profit from investing in cryptocurrencies, but you can also lose money. In this post, we’ll look at several cryptocurrency investment ideas, risk management approaches, and ways to prepare, such using a quarterly tax calculator, to help you limit your losses in this unpredictable market.

Investing strategies for cryptocurrencies

It’s vital to remember that there are numerous different cryptocurrencies out there, all with various levels of volatility, before going into investment techniques.

Diversifying one’s portfolio is a common investing strategy among cryptocurrency holders. Choosing cryptocurrencies you believe in and that have room for long-term growth is vital. Diversifying, though, doesn’t always imply investing in dozens of coins.

Investing in well-known cryptocurrencies, such as Bitcoin and Ethereum, is another successful tactic. Also, these currencies gain by being extensively traded, making it simpler to buy and sell them than less well-known cryptocurrencies.

Establish attainable goals for your finances and follow through on them.

Risk Management for Cryptocurrencies

Investments in cryptocurrencies are inherently dangerous, therefore it’s critical to have a strategy in place to reduce those risks. Stop-loss orders are a useful tool for bitcoin investors. If prices drop too low, your broker can sell. This makes sure that in the event of a downward market shift, your losses are kept to a minimum.

This is the portion of your portfolio that you allot to each trade. You may reduce your risk exposure and prevent disastrous losses by controlling your position sizes and establishing stop-loss orders.

Finally, it is advisable to refrain from trading during periods of panic or high volatility. You may decide to invest much more during a market frenzy. Waiting until the market has stabilized before making any significant decisions is a wise idea.

Tax Preparation for Investors in Cryptocurrencies

Cryptocurrency earnings and losses in the US are taxed as capital gains because the IRS views cryptocurrencies as property for tax purposes. This means that taxes on the gains are anticipated if you profit from selling bitcoin for a higher sum.

You should keep your transactional records for as long as possible to reduce your tax liability. This details each transaction’s date, cost, and sum. You can utilize software programs like CoinTracking or CryptoTrader that are made exclusively for tracking bitcoin transactions. Tax.

Holding investments for a period of time longer than a year is a crucial tax planning strategy for bitcoin investors.

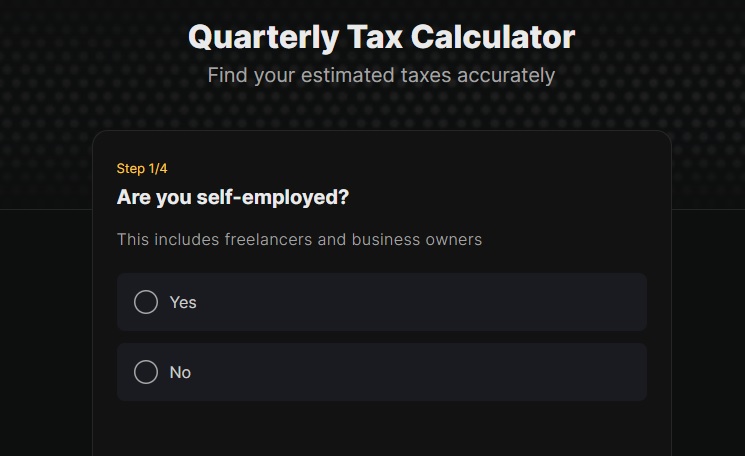

Tax deductions for self-employment

When it comes to maximizing their tax savings and paying their taxes, freelancers and other self-employed people frequently confront particular IRS tax instructions. There are, however, a number of deductions that can help lower their tax obligation.

For instance, home office deductions enable independent contractors to deduct a portion of their housing costs, such as rent, services, and internet, as business expenditures. Similar to this, expenses for business vehicles and equipment can also be written off. These deductions can quickly accumulate and assist in lowering the overall tax burden.

Tax Techniques for Freelancers

Freelancers can profit from tax-deferral tactics in addition to deductions. Having a Solo 401(k) plan is an option. Because of this, independent contractors can put up to $19,500 ($26,00 if they are over 50) of their earnings into a retirement account, which can lower their taxable income and offer further tax advantages.

Another important tactic is to obtain advice from a tax expert who will make sure that independent contractors are taking advantage of all available deductions and strategies. Many may find it challenging to keep up with the most recent developments and how they can affect self-employed professional’s 1099 taxes as tax regulations change frequently.

Also Read:- How To Calculate Electric Bill From Meter Reading In Philippines

In conclusion, despite the fact that investing in cryptocurrencies can include a number of hazards, there are ways to reduce these risks and minimize losses. Deep dive into it, maintaining a varied portfolio, and taking a methodical approach to investing are crucial.