Understanding the Volume-Weighted Average Price (VWAP) and Its Role in Trading

In the world of trading and investments, making informed decisions is the key to success. One of the metrics frequently used by traders to make those decisions is the Volume-Weighted Average Price, or VWAP. In this comprehensive guide, we’ll delve deep into what VWAP is, its importance, accuracy, and its application in trading options.

Also Read:- Understanding “Buy Here Pay Here” Dealerships: A Comprehensive Guide

1. Introduction to VWAP

Volume-Weighted Average Price, commonly abbreviated as VWAP, is a trading benchmark that offers an insight into the average price a stock has traded at, throughout a specified time frame, weighted by the volume of shares traded. It provides traders a clear understanding of both price and volume in a single metric.

2. Why is VWAP so important?

VWAP has gained traction among traders due to a plethora of reasons:

- Institutional Trading Reference: Large institutions, hedge funds, and mutual funds often use VWAP to assess the efficiency of their buying or selling decisions. Trades executed above the VWAP are considered favorable for buy orders, while those below VWAP are seen as favorable for sell orders.

- Liquidity Measure: VWAP offers a quick glimpse into the liquidity of an asset. A significantly higher or lower price compared to VWAP can indicate less liquidity and potentially more volatility.

- Intraday Trend Indicator: VWAP can be utilized as a simple intraday trend indicator. Prices above VWAP indicate bullish sentiments, whereas prices below point towards bearish sentiments.

3. How accurate is the VWAP indicator?

Like any technical indicator, VWAP has its strengths and limitations:

- Strengths: Given that VWAP considers volume, it provides a more balanced view of price activity. It’s less susceptible to short-lived price spikes compared to simple moving averages.

- Limitations: VWAP is inherently a lagging indicator. As the trading day progresses, it can become less sensitive to recent price moves. Hence, it’s primarily beneficial for intraday trades and less so for long-term assessments.

4. How do you use a VWAP indicator?

Employing VWAP in trading can be broken down into a few steps:

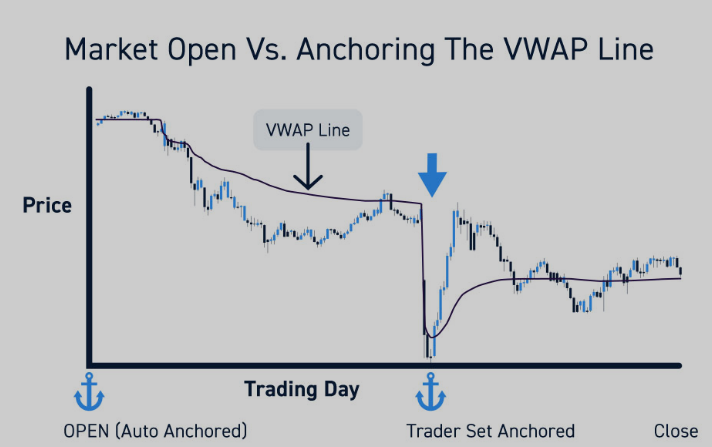

- Setting up: Many modern trading platforms have VWAP as a built-in feature. Activate it on your chart for visual reference.

- Interpreting: As mentioned earlier, if the price is above the VWAP line, the market sentiment leans bullish, and vice versa.

- Combining with other indicators: While VWAP can be potent on its own, combining it with other indicators, like moving averages or RSI, can give more refined trading signals.

5. How do you use VWAP in trading options?

VWAP isn’t just limited to stock trading; it can be an invaluable tool for options traders as well:

- Spotting Entry and Exit Points: By observing how a stock price behaves relative to its VWAP, options traders can spot potential entry and exit points for their option trades.

- Assessing Underlying Stock Movement: VWAP can help determine the momentum of the underlying stock, which can influence the option’s price. A bullish sentiment on the stock can drive up call options prices and vice versa.

- Setting Stop-loss Points: By gauging the distance between the stock price and its VWAP, traders can set stop-loss points for their options trades, minimizing potential losses.

6. Conclusion

In the intricate world of trading, VWAP stands out as a reliable and popular technical indicator. Whether you’re a novice trader trying to gauge market sentiment or an institutional investor seeking to optimize trading performance, understanding and using VWAP can be instrumental. Always remember to use it in conjunction with other tools and indicators to refine its accuracy further. Happy trading!

Frequently Asked Questions about VWAP

Q1. What does VWAP stand for?

A1. VWAP stands for Volume-Weighted Average Price.

Q2. Why is VWAP significant in trading?

A2. VWAP is crucial as it provides insight into the average price at which a stock is traded, considering its volume. It helps traders assess market liquidity and trends.

Q3. How accurate is the VWAP indicator?

A3. VWAP is generally accurate for intraday trading since it considers both price and volume. However, it’s a lagging indicator and may be less sensitive as the trading day progresses.

Q4. Can VWAP be used in options trading?

A4. Yes, VWAP can be applied in options trading to assess the momentum of the underlying stock and determine entry and exit points.

Q5. How do you set up a VWAP indicator?

A5. Most modern trading platforms have VWAP as a built-in feature. You can activate it on your chart for visual reference.