Why Managing Accounts Receivable Could Save Your Business

Running a business is expensive, and tracking where all your money is going can be challenging. However, one area that often gets overlooked is accounts receivable management. This type of management refers to the process of tracking and collecting payments from customers Here.

While it may seem tedious, managing accounts receivable is crucial to the success of your business because it ensures that you are paid promptly and in full. Understanding how accounts receivable work can help you save money and keep your business afloat. This article will explore ten ways that managing accounts receivable could save your business.

Improve Cash Flow

One of the primary benefits of accounts receivable management is improving your business’s cash flow. When customers pay their invoices on time, you will have a steadier flow of income, which can cover expenses and keep the business running smoothly.

On the other hand, if customers consistently pay late, you may struggle to make ends meet. In addition, this payment failure can lead to missed opportunities, financial penalties, and bankruptcy.

By keeping a close eye on accounts receivable, you can take steps to ensure that customers pay on time and avoid any negative consequences.

Reduce DSO

DSO, or days sales outstanding, is a metric that measures how long it takes customers to pay their invoices. A high DSO means it is taking customers longer to pay, which can strain your business’s cash flow.

Accounts receivable management can help you reduce your DSO and get paid faster. By keeping track of invoices and payments, you can quickly identify any late charges and take action to collect them. Doing this will help you get paid sooner and improve your business’s cash flow.

In addition, accounts receivable management can help you improve your invoicing process. As you streamline your invoices and make them easy to understand, you can encourage customers to pay on time.

Avoid Late Payment Penalties

Late payment penalties are fees charged by suppliers when invoices don’t get paid on time. These fees can add up quickly and strain your business’s finances. However, by keeping track of accounts receivable, you can avoid these penalties by ensuring that customers pay their invoices on time.

In some cases, suppliers may be willing to waive late payment penalties if you can provide proof that you are taking steps to improve your accounts receivable management. These steps could include implementing a new invoicing system or hiring a collections agency.

Improve Relationships With Customers

Another benefit of accounts receivable management is that it can help you improve relationships with your customers. For example, customers who pay their invoices on time are more likely to be satisfied with your products or services. In turn, this could lead to repeat business and positive online reviews.

On the other hand, if customers consistently pay late, they may become frustrated with your business. This issue could damage your reputation and make it difficult to attract new customers. In addition, late-paying customers are more likely to default on their payments, which could lead to legal action.

The more you understand your customers’ payment habits, the easier it will be to manage your relationships with them and identify potential problems.

Get Paid Faster

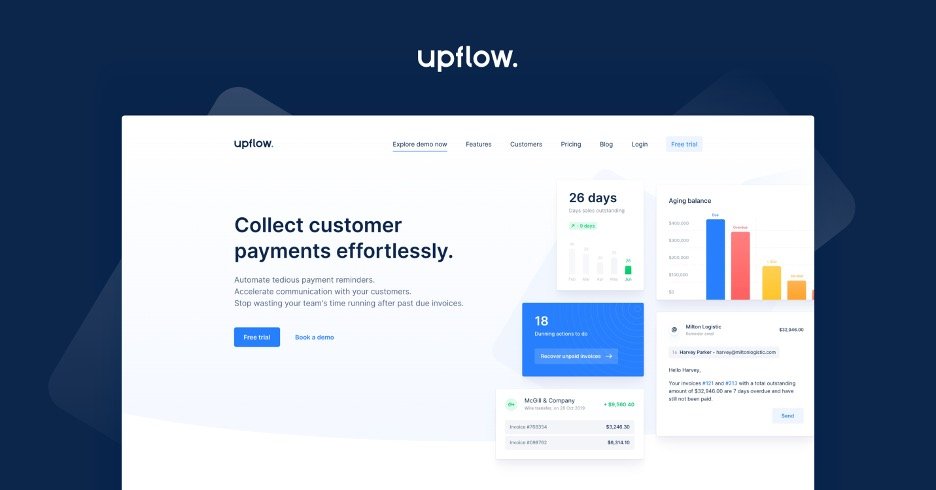

You can get paid faster by keeping track of your accounts receivable, primarily through using accounts receivable software. This software can automate the invoicing and collections process, making it easier to manage your accounts receivable. In addition, this software can send automatic reminders to customers when their payments are due.

With accounts receivable software, you can also quickly identify any late payments and take action to collect them. It will help you get paid faster and improve your business’s cash flow without disrupting the other aspects of your business.

Not all accounts receivable software is the same so be sure to understand what your business needs so that you get the right software for your business.

Understand Your Customer’s Payment Habits

Accounts receivable management can also help you understand your customer’s payment habits. You can use this information to improve your invoicing process and make customers more likely to pay on time.

In addition, you can use this information to identify any potential red flags. For example, if you notice that a customer always pays late, you may want to reconsider doing business with them. On the other hand, if you see that a customer always delivers on time, you may want to give them preferential treatment such as discounts or early access to new products.

Understanding your customer’s payment habits can help you make better decisions about who to do business with and how to manage your invoicing process. This process, in turn, can help you improve your accounts receivable, leading to a healthier business overall.

Avoid Fraud

Another benefit of accounts receivable management is that it can help you avoid fraud. For example, when invoices do not get paid on time, it can be difficult to tell whether the customer forgot or if they are deliberately avoiding payment. However, you can quickly identify any potential fraud by keeping track of your accounts receivable.

For example, if you notice that a customer always pays late but never provides a reason, this could be a red flag. You may want to contact the customer to confirm their payment method and address any concerns. In some cases, it may be necessary to take legal action to recover the outstanding payments.

On the other hand, you might notice that one of your customers consistently pays on time but always asks for discounts. While this behavior is not necessarily fraudulent, it could signify that the customer is trying to take advantage of your business. In this case, you may consider whether it is worth doing business with this customer.

Different scenarios will call for varying solutions, which makes it even more important to understand how your accounts receivable play into the rest of your business.

By keeping track of your accounts receivable, you can quickly identify any potential fraud and take action to prevent it. Doing this will help you protect your business and improve your bottom line.

Help Your Business Grow

Another benefit of accounts receivable management is that it can help your business grow. When you better understand your customer’s payment habits, you can make decisions about how to grow your business. For example, if you notice that a customer always pays on time, you may want to offer them credit so they can buy more products from you.

In addition, if you notice that a customer is always late with their payments, you may want to offer them a discount for paying on time. This incentive will help you improve your cash flow and make it more likely that the customer will pay their invoices on time.

By understanding your customer’s payment habits, you can decide how to grow your business. This information can help you improve your bottom line and make your business more successful.

Improved Customer Service

You can improve your customer service by being on top of your accounts receivable. When customers know that their payments get managed effectively, they will be more likely to do business with you. In addition, when you better understand your customer’s payment habits, you can offer them customized payment options that will suit their needs.

If you have a customer who tends to delay payments, you can think of initiatives to help them pay their invoice. For example, if you know that a customer is struggling with financial pressure, offer them a payment plan. Doing so will ensure that the invoice gets paid, and you will strengthen your relationship tenfold with the client.

Improved customer service is a crucial benefit of accounts receivable management. When you better understand your customer’s payment habits, you can offer them customized payment options that will improve their experience with your business.

Reduced Costs

Finally, another benefit of accounts receivable management is reduced costs. When you better understand your customer’s payment habits, you can decide how to lower your costs.

For example, you might have a customer who dutifully pays their invoice. To show this customer that you value their support and loyalty, you could consider lowering your costs for this customer since you know that they will pay on time or even in advance.

Should you notice that a customer is always asking for discounts, you may want to consider whether it is worth doing business with this customer. By understanding your customer’s payment habits, you can decide how to reduce your costs.

Conclusion

Accounts receivable management can help you reduce costs, improve customer service, and grow your business. When you better understand your customer’s payment habits, you can offer them customized payment options to enhance their experience with your business. By understanding your customer’s payment habits, you will get a good idea of the ebb and flow of your accounts receivable.

This information can help you improve your bottom line and make your business more successful. When you manage your accounts receivable effectively, you will save money and improve your business. It is a win-win situation for both you and your customers.