Decoding Year-Over-Year (YOY): A Comprehensive Guide

The world of finance and business analytics is riddled with jargon and terms that might sound alien to many. Among these, ‘Year-Over-Year (YOY)’ stands out as an incredibly crucial concept. This article aims to shed light on YOY, its calculations, its comparisons with month-on-month (MOM), and its significance in understanding business trends.

Also Read:- Understanding Summa Cum Laude: GPA Requirements and Distinctions Explained

What is Year-Over-Year (YOY)?

Year-Over-Year (YOY) refers to a comparison of a particular metric for one period to the same period the previous year. The YOY measurement can be applied to any data that changes over time, allowing for a clearer understanding of any evident trends.

Year Over Year (YOY) Meaning and Its Significance

YOY provides an effective way to smooth out the effects of seasonality and provide a clearer view of performance trends over time. For instance, a retail company might want to compare sales in December this year to those in December the previous year to get an accurate picture of growth, rather than comparing to November of this year.

How Do You Calculate Year-Over-Year (YOY)?

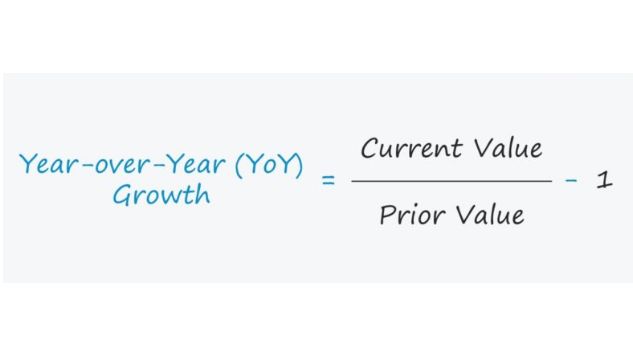

The year-over-year formula is straightforward:

YOY Growth=(Current Year Value – Last Year ValueLast Year Value)×100

This will yield a percentage that tells you how much a particular metric has grown (or shrunk) compared to the previous year.

Year Over Year (YOY) Growth and Its Implications

Year-over-year growth gives businesses a clear understanding of their trajectory. Positive YOY growth indicates that a company or metric is growing, while negative YOY growth indicates a decline.

How is YOY Different From Month-On-Month (MOM)?

The question of ‘What is MOM and YOY?’ is quite common. While YOY compares data from one period to the same period a year prior, MOM, or Month-On-Month, compares data from one month to the previous month. MOM can provide quicker feedback, but it might also highlight short-term fluctuations that don’t signal long-term trends.

Year Over Year (YOY) Formula vs. Year Over Year Growth Formula

While these might sound similar, there’s a slight nuance. The YOY formula, as explained above, gives you the growth or decline in percentage. The YOY growth formula focuses more on the absolute difference:

YOY Growth=Current Year Value – Last Year Value

Year Over Year (YOY) Calculator and Its Uses

A YOY calculator is a tool, often found online, that allows you to quickly input the values for the current year and the last year, producing the YOY growth percentage. Such calculators are handy for quick assessments without manual calculations.

Year Over Year (YOY) By Year – Understanding the Trend

When you assess YOY by year, you’re essentially comparing each year’s performance to the previous year’s for multiple years. This can help in identifying longer-term trends, patterns, or cycles in the data.

Year Over Year Example to Illustrate Its Application

Consider a startup that reported revenues of $100,000 in 2021 and $130,000 in 2022. Using the YOY formula:

YOY Growth=(130,000−100,000100,000)×100=30%

This means the startup experienced a 30% growth in revenue year-over-year.

Is it ‘Year-On-Year’ or ‘Year Over Year’?

Both terminologies are correct and are often used interchangeably. However, ‘Year Over Year’ is more common in North America, while ‘Year-On-Year’ is frequently used in other parts of the world.

The Importance of the YOY Growth Formula

In conclusion, the year-over-year growth formula provides a clear window into the performance of a business metric over time, free from the fluctuations that short-term measurements might highlight. Whether you’re assessing revenue, profit margins, or any other metric, understanding YOY growth is essential for making informed business decisions.

The next time someone asks, “What is the higher Summa or Magna?” or “Is Magna Summa Laude a 3.9 GPA?”, direct them to a comprehensive guide on academic honors and GPAs. Similarly, for questions about YOY, MOM, or other financial terminologies, refer to a resourceful guide that breaks down complex terms into digestible information. Making informed decisions, whether in education or business, stems from understanding the fundamental concepts thoroughly.