Dow Jones Industrial Average- Various Good Reasons to Invest in the Dow

Yes, the Dow 30 does have a whiff of fustiness. However, the industrials actually follow the market well and may perform better during a downturn.

This stock index is not your father’s. However, it is most likely your grandfather’s. Naturally, we’re referring to the Dow Jones industrial average, which has been monitoring the performance of the American stock market since 1896, when there were just 12 stocks in the average at that time.

The Dow is considered ancient by some, and with good reason. One of the things about it is that it only owns 30 equities, chosen by a committee made up of three S&P Dow Jones Indices representatives and two Wall Street Journal representatives. Stocks are chosen based on a variety of subjective criteria, with investor interest, company repute, and leadership in the industry all being taken into account.

Contrast that with the 500-stock Standard & Poor’s index, which is more quantitative and consists of significant publicly traded companies that were chosen based on criteria including trading liquidity and financial sustainability. The Dow weights its constituents according to share price so that more expensive companies account for a larger portion of the index than the S&P, which ranks stocks in the index according to float-adjusted market value, or share price multiplied by the number of shares available for public trading.

According to Alex Bryan, head of research for passive strategies at Morningstar, this technique is a “relic from the 19th century,” stemming from a time before computers made it simple to calculate market capitalization and other data in real time. According to him, the approach not only distorts the Dow’s depiction of the entire market but also excludes businesses with stock prices that are thought to be too high for inclusion, like Alphabet (symbol GOOGLE).

But before you give up on the Dow, “hold your horses,” as Grandpa may say. Despite having fewer investments overall, it tracks the market about as well as the S&P. The degree of correlation between the two indices over the past 25 years has been 94 percent, which indicates that they largely rise and decrease in lockstep. What little difference there is has helped the Dow. The Dow returned 10.3% annually on average throughout the course of the 25-year period, 0.8 percentage points more than the S&P. That translates to a difference of approximately $20,000 on a $10,000 investment. Recent successes have boosted that figure. The value and quality-focused Dow returned 20.2 percent last year, compared to the more diversified S&P 500’s 17.4 percent, while low-cost stocks outpaced faster-growing stocks.

Additionally, Bryan claims that the Dow is more resilient during bear markets since it concentrates on cash-rich industrial giants. For instance, the S&P fell by 55.3 percent from October 2007 to March 2009, compared to a cumulative loss of 51.8 percent for the Dow. The highly profitable Dow companies also have a greater dividend yield than those in the S&P, averaging 2.4 percent vs 2.0 percent.

For index investors, holding funds that track the overall market still makes sense. However, you can also want to increase your investment in the oldest stock index.

Dow Jones Futures: Market Rally Resilient; Apple, Tesla

On Sunday night, the Dow Jones futures, S&P 500 futures, and Nasdaq futures will all begin trading. The Nasdaq and small caps led the way in a generally solid week for the stock market rise.

However, the market rise showed resilience despite some conflicting stories as the major indices reached resistance levels after making significant recent gains.

Stocks To Monitor

The resurgence of chip stocks is encouraging for any market rally. Despite being extended from early entry but below customary buy points, Monolithic Power Systems (MPWR), KLA (KLAC), Analog Devices (ADI), Axcelis Technologies (ACLS), and Onsemi (ON) are currently in a limbo.

Investors may want to hold off on making an early entry into Apple (AAPL) while they wait to see if the stock can establish a handle.

Despite the need for a break, Tesla shares fell on Friday. In the meantime, Tesla (TSLA) has been charged with false advertising for marketing Autopilot and Full Self-Driving.

After significant advances in recent days and weeks, Celsius (CELH) finally saw a heat check. With CELH’s earnings expected on Tuesday, what should investors do with the stock?

On IBD Long-Term Leaders is the stock MPWR. The Long-Term Leaders watchlist includes KLAC stock. On the IBD 50 are CELH shares, Axcelis Technologies, Onsemi, KLA, and Monolithic Power. Onsemi, Monolithic Power, and ADI shares are included in the IBD Big Cap 20. The IBD Shares Of The Day on Friday was ACLS stock. Earlier in the week, Monolithic Power and ON stock were featured as Stock Of The Day.

Vertex Pharmaceuticals (VRTX), EQT (EQT), and ACLS stock were all mentioned in the video that was included in this article along with the market activity.

Berkshire Income

Operating earnings for Berkshire Hathaway (BRKB) increased by 39 percent from a year earlier to $9.28 billion. However, Warren Buffett’s company recorded a $43.8 billion net loss. That implies an investment loss of $53 billion during the stock market’s sharp decline, which peaked in June.

In Q2, Berkshire purchased back only $1 billion of its own stock, a decrease from Q1’s $3.2 billion. Berkshire, however, has been buying Occidental Petroleum in large quantities (OXY).

At the end of June, Buffett’s company still had $105.4 billion in cash, down from $106.3 billion at the end of March.

Last week, the price of BRKB stock decreased 2.8 percent to 292.07 while trading between its 200-day and 50-day lines. Despite having recovered from its June lows, Berkshire stock is still well off its late-March peak of 362.10.

Today’s Dow Jones Futures

On Sunday, the Dow Jones futures, S&P 500 futures, and Nasdaq 100 futures all begin trading at 6 p.m. ET.

Keep in mind that overnight trade in Dow futures and other markets may not necessarily reflect real trading during the following normal stock market session.

Stock Market Rally

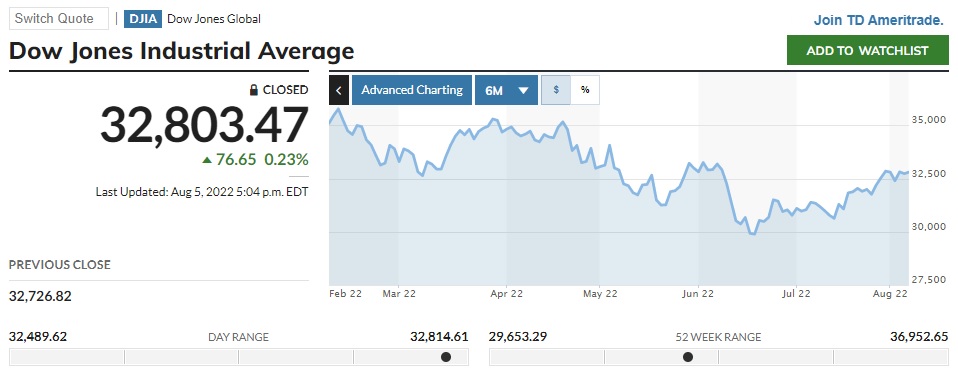

Last week’s stock market trade saw a 0.1 percent decline in the Dow Jones Industrial Average. The S&P 500 index increased by 0.4%. Nasdaq composite prices increased by 2.15 percent. The Russell 2000 small-cap index increased by 1.9%.

Following Friday’s explosive jobs report, the 10-year Treasury yield increased by 16 basis points, or 20 basis points, to 2.84 percent. Ahead of the jobs report, the likelihood of a 75 basis point Fed rate increase on September 21 increased from approximately 40 percent to two-thirds.

The price of U.S. crude oil futures fell 9.7% for the week to $89.01 a barrel, marking their lowest levels since early February, when Russia invaded Ukraine.

The Innovator IBD 50 ETF (FFTY), one of the finest ETFs, increased 2.9 percent last week while the Innovator IBD Breakout Opportunities ETF (BOUT) decreased 0.7 percent. A 3.7 percent increase was seen in the iShares Expanded Tech-Software Sector ETF (IGV). Gaining 2.7 percent was the VanEck Vectors Semiconductor ETF (SMH).

Last week, the SPDR S&P Metals & Mining ETF (XME) increased by 0.5 percent. A 0.15 percent gain was made by the Global X U.S. Infrastructure Development ETF (PAVE). The U.S. Global Jets ETF (JETS) increased 3.2%. The SPDR S&P Homebuilders ETF (XHB) eked out a 0.2 percent gain, marking its eighth consecutive weekly gain. The Financial Select SPDR ETF (XLF) fell 0.1 percent and the Energy Select SPDR ETF (XLE) fell 6.8 percent. Despite the growth in biotechs, the Health Care Select Sector SPDR Fund (XLV) declined by 0.7 percent.

ARK Innovation ETF (ARKK) and ARK Genomics ETF (ARKG) both increased by about 11 percent and 10.5 percent, respectively, last week, reflecting more speculative story equities. In all of Ark Invest’s ETFs, Tesla stock continues to be a significant investment.

Chip Stocks

On the strength of its earnings, Monolithic Power’s stock rose over 15% to $532.33 last week. On the Aug. 2 earnings gap, investors might have bought MPWR stock as it broke through several additional resistance levels. The stock of Monolithic, meanwhile, was 24% over its 50-day line and 17% above its 200-day line as of Friday’s close. The relative strength line has already reached a high, indicating the outperformance of MPWR stock relative to the S&P 500 index. There is a buy point of 580.10 on the stock from the consolidation that began in late November. In a perfect world, shares would stop and form a handle. That would provide a lower entry point and allow the moving averages to make some progress.

The same holds true for the stocks of Axcelis, Onsemi, and KLAC, all of which have recently announced earnings and are currently stretched from moving averages but below conventional breakouts. Despite Analog Devices’ upcoming earnings on August 17, the price of ADI stock remains largely unchanged.

Apple Stock

With a 1.75 percent gain to 165.35, Apple stock has now increased for five weeks running. Following earnings on July 29, the AAPL stock was available for purchase as it crossed the 200-day line. As an early entry, it is still debatably actionable at 3.7 percent above the 200-day line. The RS line for Apple stock has already reached new highs. Although 183.04 is the designated purchase target, a handle at the present price or little higher would be desirable.

Tesla Stock

The price of Tesla stock dropped 6.6 percent on Friday to $864.51, dropping 3 percent for the week as it snapped a seven-day winning streak. Consequently, shares fell back below the 200-day line. However, if the TSLA stock can maintain its present price for a few days, then a bold entry might be made by moving over Thursday’s high of 940.82. The height is insufficient for a conventional handle.

Although it had been anticipated for months, shareholders of Tesla approved a 3-for-1 stock split at the company’s annual meeting on Thursday night. Elon Musk, the CEO, spoke extensively on Tesla’s potential without making any noteworthy remarks. Elon Musk’s continuing Twitter controversy might be hurting TSLA stock.

According to legal experts, Twitter (TWTR) has a compelling argument that Musk should be required to proceed with his acquisition offer of $54.20 per share. In October, there will be a Musk-Twitter trial. TWTR stock increased 3.6 percent to 42.52 on Friday amid the most recent court filings, recovering the 200-day line and reaching its highest levels in almost three months.

According to documents first reported by the Los Angeles Times, the California Department of Motor Vehicles on July 28 accused the EV giant of deceiving customers about the capability of Autopilot and FSD. However, if the state DMV succeeds in its legal case, Tesla will probably merely need to change its advertising and marketing.